This year, organizations are navigating unprecedented challenges with COVID-19 causing a disruption in where and how some employees work. Conversations about race, discrimination and social justice have come to the forefront of public discourse due in part to the killing of George Floyd earlier this year, which set off worldwide protests that continue to this day.

How have these new challenges and conversations changed the workplace? Are employees in organizations reporting the same types of incidents to their helplines? Have trends in whistleblowing changed?

On September 24, 2020, ECI hosted a panel of 6 experts to answer these questions and more at our September Best Practice Forum, E&C Reporting Trends: Understanding the Impact of Our Current Environment including Jane Norberg, Chief of the Office of the Whistleblower, Enforcement Division, United States Securities and Exchange Commission, Anita Bandy, Associate Director, Enforcement Division, United States Securities and Exchange Commission, Jordan A. Thomas, Partner, Labaton Sucharow, Chris Burris, Partner, Special Matters and Government Investigations, King & Spalding, Carrie Penman, Chief Risk and Compliance Officer, NAVEX Global, and Justin Ross, Staff Vice President and Chief Compliance Officer, FedEx Corporation.

Read on for a synopsis of this event, including lessons learned by our speakers, important data and statistics related to reporting and more.

Missed the event? You can still purchase a ticket and view the on-demand version of the full panel – nearly 2.5 hours of content! If you or your organization (Fellows and Senior Fellows members) have already registered, you can also click the link below to view.

SEC Whistleblower Program Quick Facts

- Began in 2010 under the Dodd-Frank Act

- 33,000 tips received since inception, from every US State and 123 countries

- Has paid 97 whistleblowers over $523 million – $23 million since July 2020 alone

- Broke yearly records this fiscal year by awarding 29 whistleblowers more than $135 million

- More than $2.5 billion in financial remedies ordered for wrongdoing

- Nearly $1.4 billion returned to harmed investors

The SEC recently updated and amended the rules to the Whistleblower Program. See press release: SEC Adds Clarity, Efficiency and Transparency to Its Successful Whistleblower Award Program

SEC Whistleblower Trends 2020

The ways in which the events of the past several months, including the COVID-19 pandemic, have affected whistleblower trends is top of mind for both the SEC and organizational leaders across the globe.

Pat Harned: Steven Peikin recently shared that since mid-March of this year, your office has triaged more than 4,000 tips, claims and referrals – a 35% increase over last year. What are your thoughts on that uptick? What do you attribute the increase to?

Jane Norberg: Just to clarify, Steve was talking about overall tips that the commission had received. There are really two buckets that we look at – whistleblower tips and non-whistleblower tips. My stats go only to whistleblower tips, but his statement really holds true for whistleblower tips as well.

Last fiscal year, we reported a little over 5,100 whistleblower tips for that year. So far this year, we have received over 6,500 tips – that’s a 25% increase over last year and we’re not done with the fiscal year yet. There has been an increase and a large portion of that increase occured since March.

My thought is that, people are out of the office, people are teleworking, a lot of people have lost jobs. When you get that time and space away from the office people are thinking a little bit more about things they have seen that maybe didn’t quite seem right. Maybe they don’t feel that they have that same connection to do an internal report and instead are coming straight to the SEC. I think those are probably some of the reasons, in this very unique environment, why we may have seen an increase in tips.

Anita Bandy: In times of market volatility, or disruption, we typically see a rise in complaints. We saw that during the financial crisis of the 2008-2009 period, and COVID-19 certainly falls in the category of market disruption and volatility. Some of these complaints have to do with COVID-19, but some of them can be attributed more generally to market disruption, job loss and other factors, and others can be attributed to overall volume of complaints.

In terms of trends or areas of continued focus, a big area is disclosure controls and judgemental accounting areas when it comes to companies disclosure of financial reporting. Our division of corporate finance put out a guidance right at the beginning when the pandemic started in March 2020 that spoke exactly to this issue. It reminded companies that disclosure requirements can apply to a broad range of evolving business risks under existing rules and regulations.

Top 3 Allegations Received from Whistleblowers

Norberg and Bandy both touched on the nature of complaints and tips received by the SEC Whistleblower Program this year and discussed how they differ and the ways they are similar to previous years. These are the top 3 areas in which the SEC has received whistleblower complaints or reports:

- Corporate Disclosures and Financials

- Fraud

- Manipulation

Do Financial Incentives Drive Whistleblowers?

Norberg: Since March, we have paid a lot of whistleblowers a lot of money. It’s been in the press a lot, including a $50 million reward over the summer. So obviously a lot of people see that and it drives people to take a look at our website, so that could be another thing.

“85% of employees or former employees raised their concerns internally before reporting to the SEC.”

Harned: When the Whistleblower Office was first created, there was a lot of concern in the E&C industry and in corporations that the possibility of getting a financial reward would drive people to come to the SEC in lieu of their own internal compliance programs through their own reporting systems. Now that we are down the road a number of years, to what extent has that been the case? Do you expect that it will change even more?

Norberg: Since the program has been put in place, companies have done a really great job in taking a look at their internal reporting structures and mechanisms and making them really friendly for whistleblowers to report internally. Their comfort level is most important for being able to report internally.

Of the people that we’ve paid to date as of the end of fiscal year 2019, 69% of those were insiders of their company (employees or former employees). Of those 69%, 85% raised their concerns internally before reporting to the SEC. That is a huge number when you think about that. They really take pride in their work, really value their company, want it to do well and report internally because they believe they’re doing the right thing for their company and investors. It’s usually only when the company doesn’t take action that they end up at our doorstep.

Are your employees being seen and heard internally? Find out the strengths and weaknesses of your culture and reporting processes with ECI Advisory Services.

Effect of the Remote Environment on SEC Investigations

Harned: How is the commission shifting its resources or changing its practices during the COVID environment?

Bandy: Like much of the rest of the world, we’ve shifted to 100% telework environment and we expect to be in that mode for an indefinite period. We’ve tried to leverage technology driven ways to execute on our mission. The bottom line is that we’re really moving forward with all aspects of our investigations as effectively and efficiently as we did before. We’re trying to be more streamlined in our approach. We might be more targeted, doing more interviews than testimony, being flexible and accommodating with logistics.

Retaliation Against Whistleblowers

Jordan A. Thomas of Labaton Sucharow joined the panel along with Chris Burris of King & Spalding to discuss the presentation by the SEC. Thomas previously represented a whistleblower in a case which set records for the financial reward given.

Jordan A. Thomas: Jane talked about the fact that the commission is focused on retaliation against whistleblowers. This is an area where we will see more cases and I think any responsible organization listening to this telecast will want to avoid, because unlike traditional employment actions which are resolved on a private, non-public way, if the SEC brings an enforcement action, it’s public and what you did is widely known. It feels good for whistleblowers, but it’s bad for the organization and bad for the culture, because people within the organization are going to be more fearful about reporting.

You really don’t want [Anita] on the trail of wrongdoing, because she’s going to find the problem. One of the things that people do when they are under that enormous pressure is that they want to point at the whistleblower, talk about how bad the whistleblower is, how the whistleblower is a bad actor, and the SEC doesn’t care. What the SEC cares about is, if the whistleblower reports bribery in Bangladesh, they want to know if there is bribery in Bangladesh. When corporations start saying, “Well the person who reported bribery in Bangladesh is a bad employee and we wrote him up.” They don’t care, they just want to know if there is bribery in Bangladesh.

On the Changing Nature of Tips and SEC Reports in the Current Environment

Chris Burris: Frankly there are a lot more areas that different regulatory authorities are focused in on that can raise these types of internal reporting of events. Think back to the area of cybersecurity and privacy. Fifteen years ago, that wasn’t at the forefront of the legal and compliance world and now it is. We have a political environment and a social environment where [cybersecurity] is very much at the forefront of culture to point out where people and organizations are not living up to the ideals of the corporate world or our culture in general.

Putting aside the fact that we’re all stuck in our homes and we’re all doing Zoom calls in our pajamas and people get way too comfortable when the people they’re talking to aren’t right in front of them, they say things that they otherwise probably shouldn’t.

Hotline Calls and Reporting Trends

Carrie Penman of NAVEX Global and Justin Ross of FedEx both weighed in to provide the E&C practitioner perspective as it relates to hotline calls in the current environment.

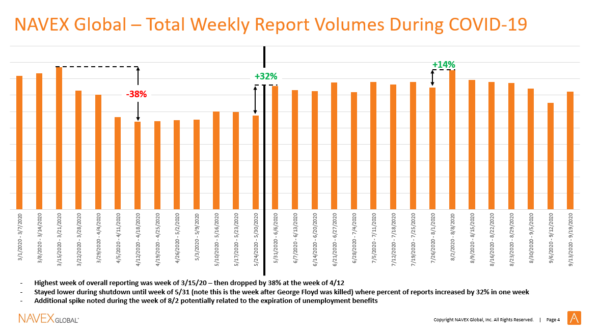

Penman shared some data from NAVEX Global’s hotline reporting data and mapped how hotline calls experienced an uptick and tracked alongside large-scale cultural trends and events. Below, you can see how NAVEX Global’s overall volume of reports increased at the beginning of the pandemic, then hit a lull, only to increase drastically again until it spiked during the week of 5/31 (the week after the killing of George Floyd made headlines).

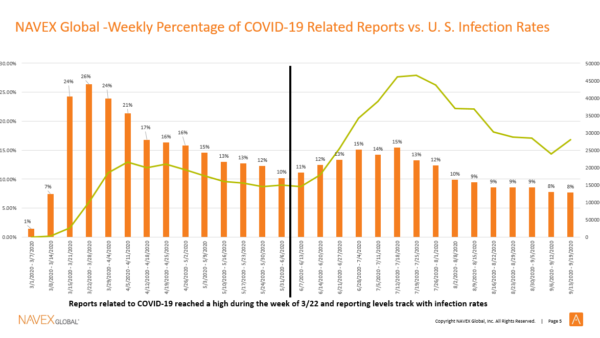

The data below shows how COVID-19 related reports increased along with infection rates in the U.S.

This post is just a small overview of the content available in this Best Practice Forum. Our presenters spent nearly 2.5 hours delivering facts, figures, statistics and thought leadership on this very important topic. You can still watch this event on-demand and earn CEU credit. Click the button below to register now.

If you are an ECI Fellows or Senior Fellows Member you can access this event at no cost. Simply click the registration link, login and you will be prompted to add a free ticket for the on-demand event to your order.