The breadth and expense of regulatory compliance have skyrocketed since the 2008 financial collapse. In 2015, the Federal Register expanded by 81,611 pages, adding 3,378 new rules and regulations. From data protection to enforcement, organizations large and small are subject to increased regulatory pressures.

Many cash-strapped companies lack the compliance resources for policy analysis, creation, and integration. Due to compliance demands, “regulatory fatigue” pushes companies to under-comply or ignore regulations outright.

The surveyed difference in cost between sustaining compliance was found to be $6 million, on average. Despite these startling figures, 38% of CCOs say their budget is insufficient to meet regulatory requirements.

A shifting regulatory landscape means ethics and compliance failure is guaranteed for some. Should you find yourself in this position, an obvious question emerges …

How can you turn compliance failure into future success?

Today, we’ll look at paradigms that help CCOs and CIOs turn a compliance misstep into a springboard for positive change. To rebound towards ethics and compliance fulfillment, new strategies are required.

Coach a New Compliance Mindset

Compliance failure is instrumental to future success. Policy is top of mind following a misstep, so rally this momentum around compliance improvements in your organization.

Rather than punish mistakes and push employees towards hiding future mishaps, be instructive. This will help dispel fear surrounding regulatory policy and keep morale high. In this malleable timeframe, raise awareness by coaching how to recognize and prevent future compliance failures.

Strong leadership is critical for helping teams embrace responsibility and alter behavior. Stanford psychologist Al Bandura proved that leaders are role models to those below them in the organizational hierarchy. Because admiration is the proclivity to imitate, you can promote compliance with action.

For example, participate in innovative events, forums, and share newsletters to disseminate information. Emphasize personal responsibility as integral to organizational success. Signal that vigilance is required in face of continuous policy changes. This fosters a culture of accountability that views compliance as a matter of personal responsibility.

A shift towards transparency and honesty encourages the entire group to align for compliance. Acting as a signpost gains you the allegiance of the organization chart, foster a sense of confidence in shareholders, and reinforce market trust.

After a misstep, leaders must coach their teams towards a sustainable and advantageous mentality. A strong example of what’s expected will restore a positive attitude and predict future compliance success.

Create New Data Management Systems

(Source)

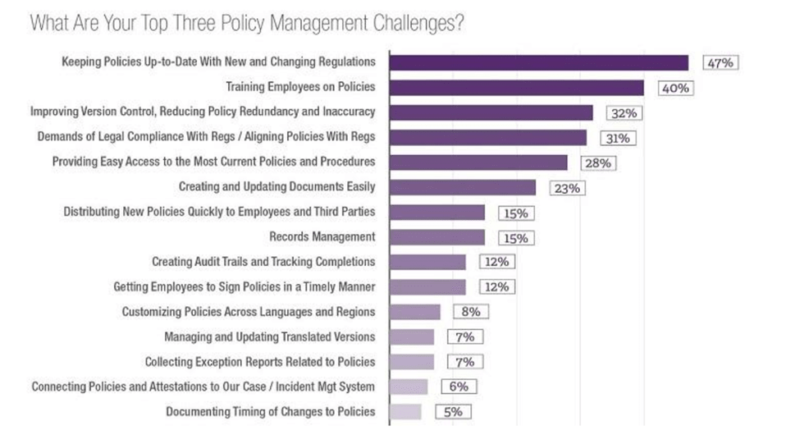

Openness and willingness to learn are crucial. Still, organizations must also establish effective systems to ensure regulatory compliance. 47% of organizations report that keeping policies up to date is the most difficult regulatory challenge. At scale, data management hinges upon the identification, dissemination, and analysis of laws and enforcement actions.

The capture and dispersal of regulatory insights are the first steps in achieving a solution. A central knowledge base will further help your teams manage, codify, and disseminate policy data. Software systems offer the capability to store, sort, and distribute knowledge across multiple channels.

This allows employees to better document internal processes, automate IT, and access compliance data. In order to mitigate future risk and ensure you’re on track, a comprehensive overview of compliance must be accessible in real-time. As a recent ADP survey observes:

“Once organizations realize they’ve fallen into a compliance gap, they may already be well on their way to incurring costly fines and penalties.”

Our recent research found that 32% of organizations don’t gather information on enforcement actions, and fail to monitor change that could mitigate compliance risk. In addition to a knowledge base, designate a regulatory group to proactively collect and coordinate compliance functions.

For example, deliver reports that interpret and frame regulations with respect to specific groups. Ready-made ethics and compliance data will ensure teams are informed and updated with the latest policy news.

To streamline the dissemination of compliance changes, regulatory teams should outline a procedure for processing and serving relevant data across departments. Instituting a standardized procedure corrects policy myopia because it delivers actionable information to those who need it. Avoid misunderstandings and oversights by educating your organization through a reliable chain of responsibility.

Over to You

To rebound from compliance failure, leverage your leadership to show employees their crucial role in mitigating risk. When combined with a framework for accessing and distributing policy information, a culture of accountability safeguards against policy mishaps.

Ensure your compliance team accesses all relevant regulatory data and establishes a protocol for serving the rest of the organization with regulatory updates. Turning compliance failure into success starts from the top-down and sustains itself through shared understanding and attention.

Sources:

- https://www.adp.com/boost/articles/turning-compliance-failure-to-success-11-845

- https://www.forbes.com/sites/sungardas/2014/07/14/failing-your-compliance-audits-and-dont-know-why-this-is-the-reason/?sh=1fa21ec34679

- https://www.bain.com/insights/how-banks-can-win-regulatory-endgame

- https://www.wsj.com/news/risk-compliance-journal

- >http://searchcio.techtarget.com/magazineContent/How-CIOs-Are-Rebounding-From-Compliance-Shock

- https://www.forbes.com/sites/williamdunkelberg/2016/07/12/the-cost-of-regulations/?sh=530777996c81

- https://compliancesurvey.dlapiper.com/